October 30, 2020

Article

Buy or rent? As agricultural accountants we deal with a mix of both owned farm businesses, tenant farmers, estate landowners and a mix of the three.

Most of our tenant farmers would strive towards one day being able to purchase a farm, whether it be the current one they operate on, or another. However, with land being at an average of £8,000/acre, does it really stack up to purchase?

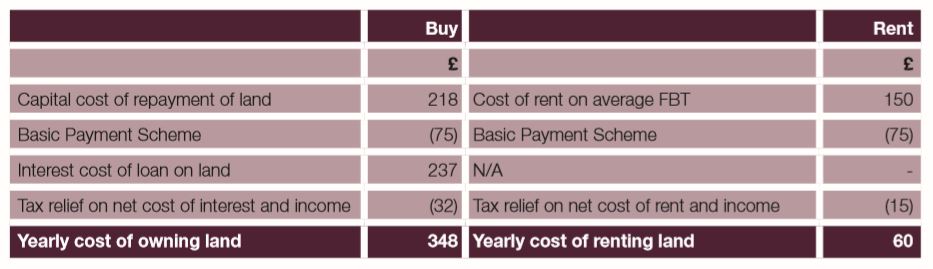

If we consider the following two scenarios:

1. You purchase an acre of land for £8,000 with all of the value being on a loan for 25 years at 3% interest.

2. You are a tenant farmer with a farm business tenancy (FBT) and you rent an acre of land for £150/acre with BPS being claimable by the tenant of £75/acre

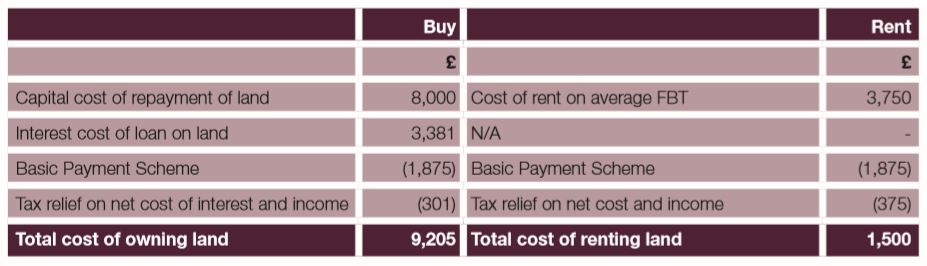

On purely a year for year basis, it would therefore look like a fool’s game to purchase land. However, if we consider the long term, of say, the land being on FBT and the loan being on a 25-year term, then over the 25-year period the following applies:

Buy or Rent?

Though on a total basis it will still cost you more to buy than rent, it is important to consider the investment you have made. If you remove the £8,000 capital cost of the land, then buying the land is actually cheaper than renting it.

As a tenant by the end of the 25-year term you are left with nothing except any retained profits you have kept from trading.

However, as an owner you are left with an asset. An asset which if we look back historically has almost always increased in value.

Of course, it is also the case that from the end of the 25 years you can continue to farm the assets with no finance costs at all. Whereas, as a tenant you may be able to negotiate a new FBT, but you will continue to pay that rent cost.

In practice, the difference in cost of purchase versus rent is negligible, for tenant farmers the goal is to one day own their own farm and that initial cost is one they may bear in the short term in lieu of future generations benefiting as a result.

It is however important as purchasers you consider the total debt service cost for your farming business and your ability to service any debt before looking to purchase any land.