October 16, 2020

Article

The Annual Investment Allowance (“AIA”) was increased temporarily to £1,000,000 from 1 January 2019 but the intention is this will revert to just £200,000 from 1 January 2021.

The Annual Investment Allowance entitles businesses to a 100% deduction against profits for the cost of purchasing capital equipment / plant and machinery in the year of purchase. Most types of plant and machinery – such as computer and office equipment, vans, lorries, coaches, tractors, diggers and cranes – qualify for AIA, as well as integral features. The main exception is motor cars.

Where qualifying capital spend is made in excess of the AIA, the excess will usually qualify for writing down allowances (“WDAs”), where tax relief is available at 18% or 6% depending on the nature of the spend.

OVERVIEW OF CHANGES

For accounting periods that straddle 31 December 2020, the last day where the Annual Investment Allowance is set at £1,000,000, great care will be needed to quantify the AIA available to a business to ensure it does not miss out on significant tax relief.

The first step will be to quantify the AIA for a period, as it will be necessary to time-apportion the applicable AIA limits to arrive at the maximum AIA entitlement for a business.

Care then needs to be taken when timing the purchase of capital equipment as there are certain restrictions imposed for those accounting periods that straddle the changes in AIA entitlement.

ACCOUNTING PERIODS STRADDLING THE REDUCTION IN AIA TO £200,000

The AIA available to businesses with accounting periods ending after 31 December 2020 comprises two parts:

1) the first based on the temporary £1,000,000 annual cap for the portion of the period falling before 1 January 2021, and

2) the second based on the £200,000 cap for the portion of the period falling on or after 1 January 2021.

For example, a company with a 12-month period to 31 January 2021 has an AIA available for the year of £933,33, made up of 11/12 of £1,000,000 and 1/12 of £200,000.

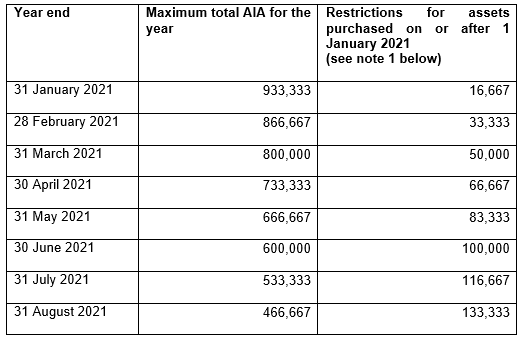

Year end Maximum total AIA for the year Restrictions for assets purchased on or after 1 January 2021

(see note 1 below)

Note 1

The timing of the purchase of capital equipment will need to be carefully considered as the transitional rules mean that unfortunately the maximum total AIA for the period is only available on additions made on or before 31 December 2020. For any assets acquired in the 2021 months, the AIA available for these purchases is restricted as shown in the table above.

For example, a company with a year end of 31 March 2021 will have a maximum total AIA entitlement of £800,000 for the year. Of this amount, only £50,000 will be available to claim against additions made after 31 December 2020 (in the 2021 months). The company would however be able to claim the full £800,000 against additions made between 1 April 2020 and 31 December 2020.

PLANNING OPPORTUNITIES

Where possible a business should bring forward its capital purchases and ensure these are made ahead of 31 December 2020, to benefit from the maximum Annual Investment Allowance available. As a reminder, where costs are not covered by the AIA they will normally attract WDAs at annual rates of 18% or 6% - although tax relief is then delayed over several years.

Where it is not commercially viable to commit to such purchases in the current calendar year, care should be taken when deciding on the purchase date to ensure the most favourable tax relief in the year of spend is achieved. This may mean that the asset purchase is delayed until a period end that falls after 2021 when the business can benefit from the full £200,000 of AIA without timing restrictions. This could lead to faster tax relief for the business overall.

For example, a company with a March year end is considering the purchase of £200K of plant. It is not possible for this to be made before 31 December 2020 and so the directors are considering when to buy. If the asset is bought on 1 March 2021 just ahead of the 2021 year end, only £50K of the AIA will be available for offset because of the transitional rules, meaning total corporation tax relief in year 1 will be given of £9,500 (based on the residual qualifying for 18% WDAs). The remaining tax relief would then be awarded year on year at 18% WDAs on the residual balance.

If the purchase had been delayed until 1 April 2021 (the start of the 31 March 2022 year end), the company would have benefitted from the full £200,000 of AIA, meaning the asset would have been covered in full, with 100% relief given in year 1, and a total tax saving of £38,000 made. An increase in tax saved of £28,500 by delaying the purchase by a month.

OTHER CONSIDERATIONS

The availability of AIA can depend on many factors, including the date the expenditure is deemed to be incurred and this can be complicated where financing arrangements, stage payments and extended payment terms are in operation. The AIA must also be shared across groups of companies or companies under common control.

If you are planning on incurring significant capital expenditure soon, you may find it useful to get in touch. This is so we can advise you on the best time to incur this expenditure and ensure your business does not miss out on the potential tax relief available.